Travel Shopping Hacks: How to Buy Luxury Items Abroad and Save on Taxes & Fees

Remi Patel

2025-12-18

6 min read

Traveling abroad isn’t just about sightseeing, tasting local cuisine, or exploring cultural landmarks—it’s also a golden opportunity for savvy shoppers to score luxury items at prices often lower than at home. From designer handbags in Paris to high-end watches in Switzerland, international shopping offers not only unique products but also the potential to save significantly on taxes, duties, and other fees. The key is knowing how to navigate local regulations, take advantage of tax refunds, and plan strategically before making a purchase.

Understanding VAT and GST Refunds

Most countries in Europe, Asia, and parts of the Middle East impose a Value Added Tax (VAT) or Goods and Services Tax (GST) on goods sold within the country. These taxes can range from 5% to 25%, but tourists are often eligible for a refund when leaving the country. To benefit, you need to request a tax refund form at the time of purchase, retain receipts, and follow the rules for export. Items typically must be unused and brought in your carry-on luggage. Refunds are usually processed at the airport before departure, with some locations even offering digital submission to streamline the process.

Research Local Prices Before You Travel

Luxury goods vary significantly in price depending on the country. Exchange rates, import duties, and local demand all influence the cost. Before planning your shopping trip, research typical prices in your destination to ensure you’re actually getting a deal. European designer handbags or Italian shoes, for example, often retail at lower prices in their country of origin than in the U.S., even before tax refunds are applied. Online brand websites, travel blogs, and pricing comparison tools can help you benchmark costs effectively.

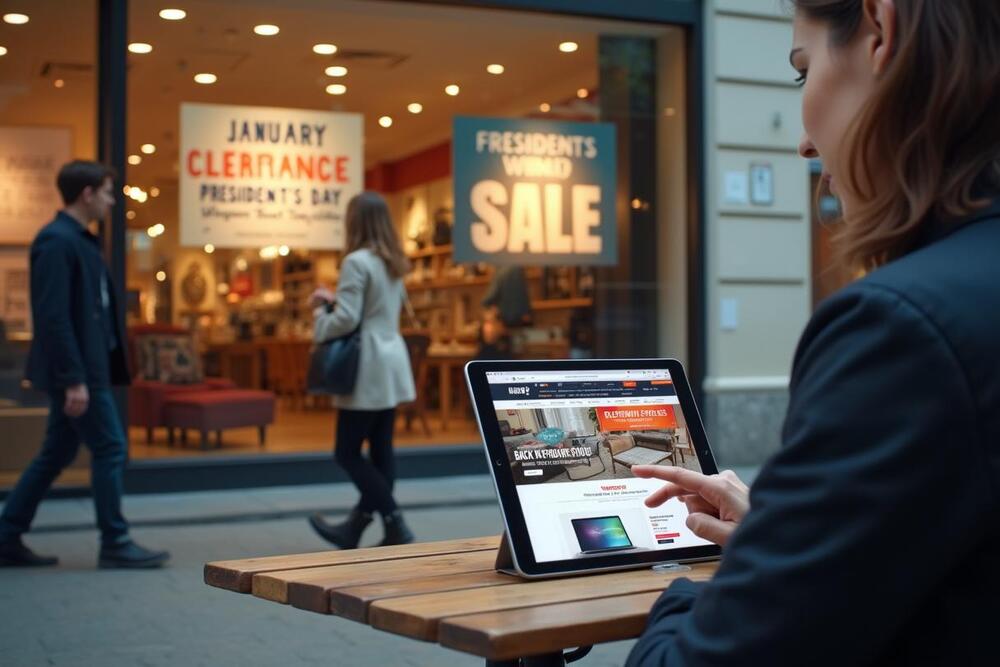

Timing Purchases Around Sales Seasons

Shopping strategically during seasonal sales can greatly enhance your savings. Many countries have designated sale periods tied to national holidays or the end of fashion seasons. France holds “soldes” in January and July, offering substantial discounts, while Italy follows a similar pattern with mid-year and post-holiday sales. Japan’s New Year sales often include limited edition items at attractive prices. Aligning your trip with these periods allows you to combine seasonal discounts with tax refunds, maximizing value on high-ticket purchases.

Shop at Authorized Retailers for Safety and Tax Benefits

While online marketplaces may offer tempting deals, purchasing from authorized retailers ensures authenticity and access to VAT/GST refunds. Flagship stores often provide exclusive items, personal shopping assistance, and access to limited editions, while guaranteeing that your investment is legitimate. Shopping in reputable stores also reduces the risk of counterfeit products, giving peace of mind that your purchase will hold its value over time.

Consider Customs Regulations in Your Home Country

Even if you get a refund abroad, your purchases might be subject to customs duties when returning home. Rules vary by country. For instance, the United States allows travelers to bring back up to $800 per person duty-free, while Australia and other countries have different thresholds. Understanding these limits in advance prevents unexpected taxes and ensures that your purchases remain cost-effective. Some travelers manage this by distributing items among family members or carefully planning carry-on versus checked luggage.

Make Use of Airport Tax Refund Services

Most international airports have tax refund desks or kiosks for tourists. These offices allow you to process VAT/GST claims efficiently, sometimes providing immediate reimbursement via credit card or cash. For travelers purchasing high-value items near departure, these services are essential. Some airports also offer mobile or digital submissions, reducing wait times and simplifying the process.

Credit Card Strategies for Additional Savings

Using the right credit card while shopping abroad can further enhance savings. Look for cards that have no foreign transaction fees and offer points, cashback, or travel-related rewards. Many premium cards also include purchase protection or insurance, which is useful when buying expensive items overseas. Combining these benefits with VAT refunds and seasonal sales can result in significant overall savings.

Pack Strategically to Protect Your Purchases

Luxury items require careful handling. Consider using your carry-on for fragile or high-value items to avoid damage in checked luggage. Leave space in your bag for new purchases and use protective packaging provided by stores. Thoughtful packing ensures that your items arrive home in pristine condition, preserving both their value and your enjoyment.

Buying luxury items abroad can be an exciting and financially savvy part of your travel experience. By understanding VAT and GST refunds, researching local prices, shopping during seasonal sales, sticking to authorized retailers, and complying with customs regulations, travelers can enjoy world-class products while keeping costs manageable. Additional strategies, including airport tax services, credit card rewards, and careful packing, further enhance savings and convenience.

From the boutiques of Paris and Milan to the high-end stores of Dubai and Tokyo, luxury shopping abroad offers more than just products—it provides an immersive experience that combines culture, style, and smart financial planning. With preparation and strategy, travelers can indulge in designer fashion, rare collectibles, and exclusive goods while keeping both their wallet and peace of mind intact.

More Trending Articles

Smart Airports: The Rise of Biometric Check-In and Automated Border Control

Sofia Rodriguez

2026-02-01